Are you continuously pestered by relentless calls from One Street Financial offering you loans? You’re not alone. This form of “Robocall” has become an insidious part of everyday life.

This article aims to guide you on how to recognize these scam calls, know the risks, how to respond, and your role in reporting these fraudsters.

Recognizing One Street Financial Scam Calls

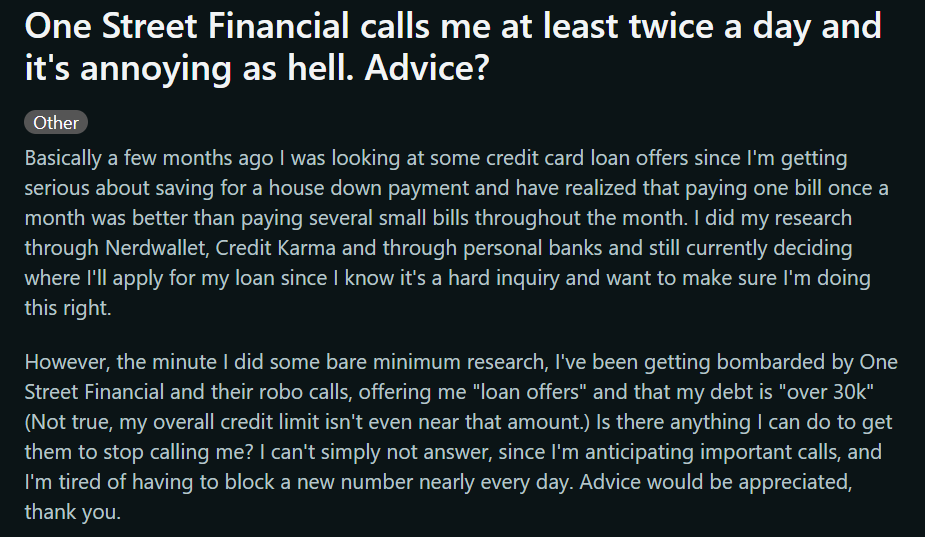

Are you on the receiving end of non-stop calls from One Street Financial boasting unbeatable loan offers? Tread carefully. There’s a strong likelihood you’re being targeted by scammers.

Masquerading as One Street Financial, these tricksters employ robocalls — an autodialer delivering pre-recorded messages — as a weapon of deception.

These calls usually kick off with a persuasive recorded message about an attractive loan deal. Before you know it, they are asking for your private financial details. Be aware, and don’t let the allure of an enticing loan offer blind you to the potential risk.

Recognizing the Red Flags

How can you spot the danger signs that you’re being targeted by a One Street Financial scam call? It’s all about staying vigilant and being aware of the telltale signs. For starters, the first red flag is if the call is unsolicited.

Reputable institutions typically will not reach out without prior communication. Another warning sign is if the caller asks for your personal or financial information over the phone. Legitimate businesses won’t request such sensitive details via a phone call.

Also, stay wary of pressure tactics that push you into making quick decisions or immediate payments to lock down the loan offer. These are scare tactics designed to catch you off guard and force a hasty decision. Stay alert, and remember that if something sounds too good to be true, it probably is.

The Potential Dangers of Scam Calls

When the sly tricksters of One Street Financial scam calls have your personal data at their fingertips, the consequences can be disastrous. Imagine your identity stolen, your credit score plummeting, and your bank account reduced to zero — that’s the grim reality these scammers can unleash.

Beyond the financial devastation, there’s the psychological trauma of feeling violated and helpless. And let’s not forget the most vulnerable among us: the elderly.

These individuals, often less familiar with the nuances of modern technology, are frequently the prime targets of these scammers. The losses they face can be catastrophic. As such, understanding the potential dangers of these scam calls is the first step in protecting yourself and your loved ones.

Empowering Yourself: How to Respond

When it comes to guarding yourself against these deceitful calls, the first line of defense is recognizing an unknown number and resisting the urge to answer it. On the off chance you do respond and are met with a pre-recorded spiel, disconnect without hesitation.

It’s essential not to get roped into their tactics, especially if the message suggests that pressing a number will exclude you from their call list – don’t fall for it! This trick only verifies that they’ve hit an active number, inviting more nuisance calls.

Most importantly, keep a tight grip on your personal details. Never, under any circumstances, should you reveal sensitive information to unsolicited callers. After all, your data is your power – don’t hand it over.

Reporting to Authorities and Your Role

Have you been on the receiving end of a scam call from One Street Financial? Don’t just ignore it – make sure your experience is heard by those who can make a difference. The Federal Trade Commission (FTC) is committed to tackling these fraudulent practices, but they need your help. By reporting your experience to the FTC, you’re contributing invaluable data that can aid in shutting down these scams.

But don’t stop there. Make sure to also notify your local law enforcement agencies. They may not be able to take direct action against the scammers, but they can raise awareness in your community and work to prevent local residents from falling victim to these fraudulent calls.

And remember, reporting isn’t just about stopping the calls you’re already receiving. By registering your number with the National Do Not Call Registry, you’re taking a proactive step to minimize future unwanted calls. This simple action could make a huge difference in the number of robocalls you receive.

Your role in this battle is crucial. Your vigilance, your reporting, and your refusal to be silent can make a significant impact. Let’s join forces and work together to put an end to the One Street Financial scam calls.

Conclusion: Staying One Step Ahead

Navigating the modern, technology-driven world can often feel like a daunting task, especially when it comes to the threat of scam calls like those from One Street Financial. However, knowledge is power.

Equipped with the ability to identify these scams, respond effectively, and report incidents to the authorities, you are much more than a potential victim; you become a powerful ally in the fight against such fraudulent activities. Armed with this awareness, you become a protective shield, not only for yourself but also for your community and vulnerable individuals who might be primary targets.

In the end, it all boils down to remaining alert and not letting your guard down. It’s about consistently valuing your personal information and treating it with the care it deserves. Remember, a vigilant community is a strong community.

If we all do our part to stay informed, report scams, and protect our personal information, we can effectively stand up against the deception of One Street Financial scam calls. Together, we can ensure the safety and security of our communities in this digital age. Let’s strive to stay one step ahead, turning the tables on these fraudsters, and claiming victory over these invasive scams.